Managing money for a parent with dementia while they live independently can be quite challenging, especially with all the expenses that come with it. From energy bills to private care services, taxis, and more, it can be tough to keep track of everything. However, one issue that I was struggling with was day-to-day cash flow. It can be quite hard to manage.

As my mum lived at the top of a hill, I would make regular trips to the shop to take fresh groceries to her.

After unpacking, my mum would want to pay me the amount I’d spent on food; for her, it was an urgent problem that she needed to address immediately, I just wanted to speak to my mum, but until she paid me in full, it could get very stressful, one time, she even made me drive her to the cash machine to hand me money!

My mum was worried that if she didn’t pay me straight away, she might forget, and while that wouldn’t have been a problem for me, she liked to pay her way.

In addition to food, there were other things that I bought for her, like her mobile phone bill and anything that I purchased through Amazon for her; again, she would pay me in cash;

I didn’t want to deal with cash and preferred that my mum didn’t have to keep too much money in her house; it was a security risk she didn’t need to take.

My mum had always been mrs independent, but as I learned for me and my mum, dementia and money management could be frustrating for both of us until we devised our cashbook system.

The Cashbook System

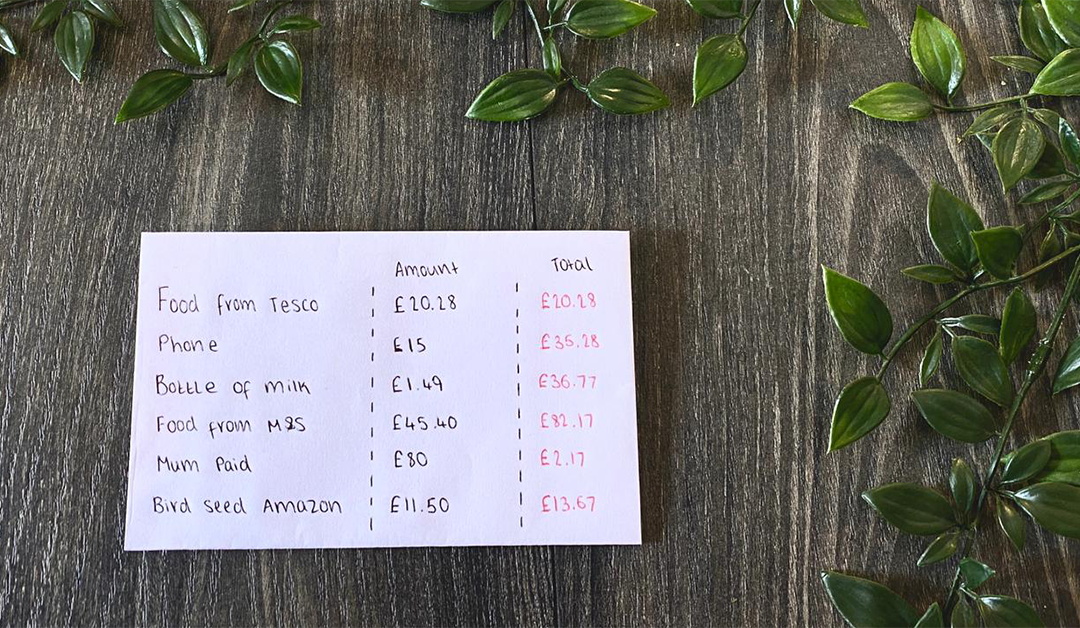

Each time I’d spend some money for her, we would enter it into a book, value on the left and a totalised value on the right, and occasionally she would give me money to clear the amount, which would be subtracted and logged in the book.

It worked well for us; we had a special place in her kitchen for the book. She would let out a huge, exaggerated sigh of relief each time we entered things into it.

There were times when we would pass a shop, and she would insist on paying, but this was ok; she wanted to maintain the routine of purchasing things from a shop in her life, and that’s great for keeping that feeling of financial independence.

How to create your cash book

We used an a5-sized book, which gave us enough space and was easy to find.

Each time you buy something, put a name in the left column to help you remember what it was for later. Also, add value in the middle column.

The right-hand column represents the total debt, so add the new amount to the previous total, so if you spend £20.28 at Tesco and your next entry is a phone bill for £15, the total will be £35.28

When “debt collecting”, enter the amount they give you in cash or a bank transfer.

Write “paid” on the left, with the amount in the middle and subtract this amount from the right-hand column.

Daren David Taylor

Creator of the Helping Mum app

Daren devotedly cared for his mother’s well-being, who was living with dementia. To assist himself and other caregivers in similar situations, he developed the “Helping Mum” app. This application serves as a tool for facilitating communication and sharing memories between caregivers and their parents. By creating the app, Daren aimed to provide a valuable resource for individuals caring for loved ones with dementia, enabling them to enhance their interactions and maintain a connection through shared memories.